Tarps News Categories

Market Analysis Report on Lumber Tarps in the U.S.

I. Core Product Model Classification and Features

The product models of Lumber Tarps in the U.S. market are primarily categorized by size, material weight, and specialized types to meet the transportation protection needs of various goods such as lumber, steel, and coiled materials.

1. By Size and Coverage Capacity

The following three main standardized sizes for flatbed truck lumber transportation account for over 80% of the market:

16 ft × 28 ft: Suitable for small to medium flatbed trailers, ideal for short-distance delivery or lightweight lumber (e.g., pine). Cost-effective, typically made of 10 oz–14 oz polyethylene.

20 ft × 28 ft: The mainstream model for medium-sized transportation, balancing coverage area and cost. Commonly used for local construction lumber delivery, primarily made of 14 oz–18 oz material with reinforced edge tear resistance.

24 ft × 28 ft: Designed for extra-long trailers or large equipment (e.g., engineered wood components). Standardized with 18 oz+ heavy-duty material and dome design to enhance drainage and prevent water accumulation damage.

Other Specialized Sizes:

Steel/Coil-Specific Models (Steel/Coil Tarp): E.g., 30 ft × 30 ft square size, requires additional wind tube design and brass grommets (one every 2 ft) to prevent steel coil movement and puncture.

Custom Sizes: E.g., 12 ft × 24 ft (vinyl dome) for special machinery, or 8 ft "drop design" tarps for covering tilted lumber in storage yards.

Dump Mesh Tarps: E.g., 7 ft × 20 ft, 7 ft × 22 ft, 7.5 ft × 20 ft, 7.5 ft × 22 ft, etc., used for automatic or manual rolling system for truck. Requires additional rolling design and 35 cm width PVC padding to reduce mesh wear during use.

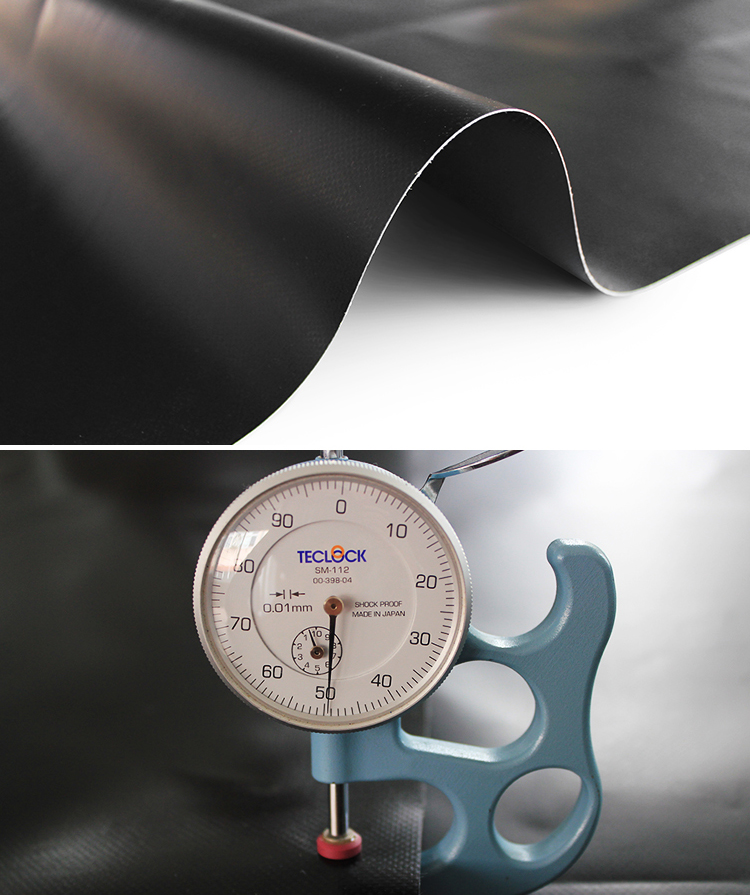

2. By Material and Durability

Material weight (oz/sq. yd.) directly determines application scenarios:

Lightweight (10 oz–14 oz):

Material: PVC-coated fabric (e.g., 1000D polyester base).

Scenarios: Scrap lumber transport, temporary construction site coverage, cost-sensitive applications.

Heavy-Duty (18 oz and above):

Material: Composite fabric (high-strength polyester + PVC coating), 610 gsm high-density polyester.

Features: UV-resistant, tear-resistant (scrim-reinforced), withstands -40°C.

Scenarios: Long-distance hardwood transport, forestry field coverage.

Heavy-Duty (22 oz and above):

Material: Composite fabric (high-strength polyester + PVC coating), 750 gsm high-density polyester

Features: Flex-resistant, tear-resistant (scrim-reinforced), withstands -40°C.

Scenarios: Agricultural covers, construction debris bags, heavy-duty lifting bags.

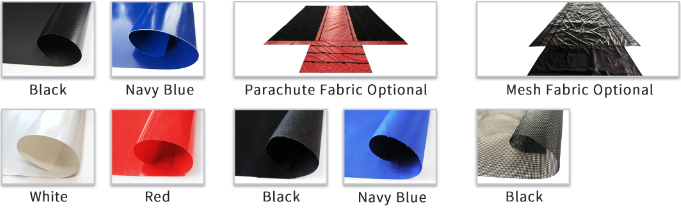

Specialty Materials:

Flame-Resistant (FR Tarps): Compliant with regulations in states like California, used for mining zone transport.

Dual-PE Coating (Silver/Black): Silver side reflects UV, black side insulates, suitable for multi-climate equipment covers.

3. By Specialized Product Type

Lumber Tarps (Wood-Specific):

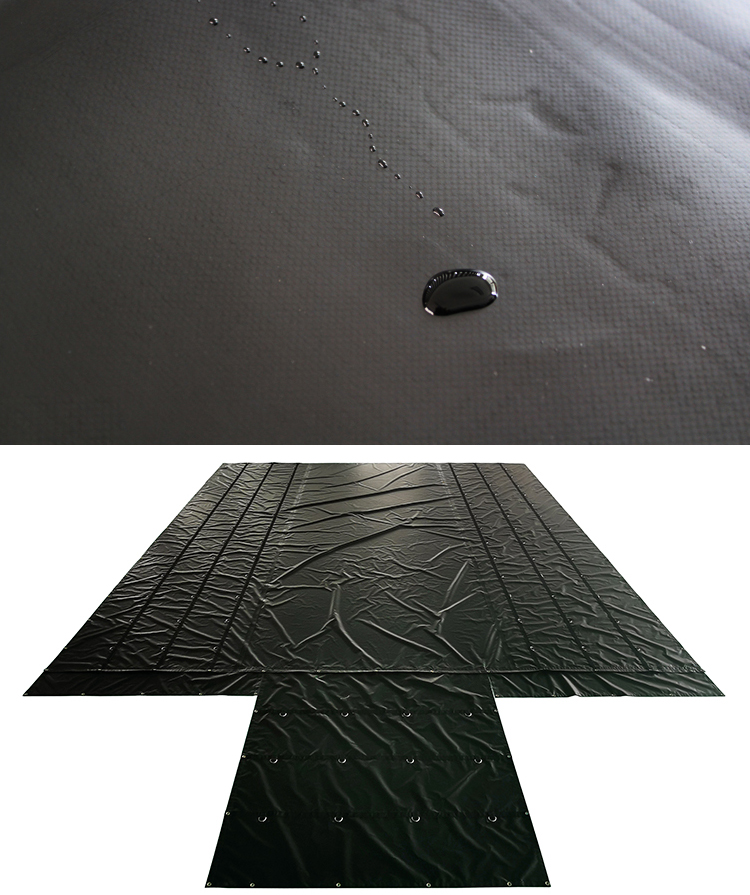

Key Design: Dome-top drainage, double-stitched corners, reinforced edges (to resist lumber friction).

Steel/Coil Tarps (Steel-Specific):

Features: Upgraded 1100D×1100D polyester base, brass grommets every 2 ft, puncture-resistant.

All-Purpose Tarps:

E.g., Costco’s 12 ft × 16 ft HDPE canvas (186 gsm), suitable for temporary yard coverage but not professional transport.

Comparison Table of Mainstream Size Product Parameters:

| Size (ft) | Core Application Scenario | Typical Material Weight | Price Range (USD) | Special Design |

| 16×28 | Short-distance delivery, lightweight lumber | 10–14 oz | $85–95 | Flat top, heat-sealed edges |

| 20×28 | Local construction lumber delivery | 14–18 oz | $105–115 | Optional dome top, double-stitched edges |

| 24×28 | Large equipment, oversized lumber transport | 18 oz+ composite | $132–142 | Dome top, wind tubes, D-ring reinforcement |

II. Application Scenarios and Model Matching

Lumber Transport and Logistics

Long-Distance Cross-State Transport: 24 ft × 28 ft dome-top (18 oz+ composite), wind-resistant and reduces water pooling. Example: Forestry to processing plant routes.

Rail Intermodal: 20 ft × 28 ft heavy-duty (610 gsm), requires ASTM tear resistance certification for multi-handling friction.

Steel and Coiled Material Transport

Steel Coils (Coil Tarp): 30 ft × 30 ft square design, 18×18 base fabric density, brass grommets for cable fixation to prevent rolling.

Heavy Machinery: Custom 12 ft × 24 ft vinyl tarp (20 mil thickness), heat-sealed seams for waterproofing, suitable for precision equipment.

Construction and Field Scenarios

Temporary Storage: Lightweight 16 ft × 28 ft tarp (10 oz) for open-yard coverage, lower cost than heavy-duty models.

Forestry Staging Areas: 18 oz green custom tarps (weatherproof labeling), adaptable to humid, multi-terrain environments.

III. Market Trends and Demand Drivers

Construction Industry Driving Standardization: Rising housing starts have made 16/20/28 ft sizes the industry default, accounting for over 60% of manufacturer capacity.

Growing Demand for High-Strength Materials: Due to high wear rates in hardwood transport, orders for 18 oz+ composite fabrics (e.g., 1000D×1300D polyester) are increasing by 15% annually.

Cost and Regulatory Pressures: Small transport firms prefer 11 oz ripstop and 14 oz basic models, while California mandates flame-resistant (NFPA-701) models with a 30% premium.

IV. Competitive Landscape

Leading Suppliers: Chinese manufacturers dominate the OEM market, with daily production capacity exceeding 200,000 sq. meters, favored by price-sensitive buyers.

Local Brand Differentiation: U.S. distributors focus on dome design + localized service, charging a 50% premium but offering rapid replacement guarantees.

Conclusion

The U.S. Lumber Tarp market’s differentiation centers on scenario-driven model adaptation:

Size standardization (16/20/24×28 ft) meets basic lumber logistics, material upgrades (18 oz+ composites) address high-wear scenarios, and specialized designs (dome tops/grommets/flame resistance) cater to niche demands.

Future competition hinges on: ① Production flexibility amid construction cycles; ② Breakthroughs in high-end models (e.g., -40°C cold-resistant); ③ Localized distribution service integration; ④ Strength improvements in low-weight materials.

you may also like

- European Side Curtain-Silver gray

- 14 oz lightweight waterproof lumber tarp Waterproof Tarps For Flatbed Truck

- PVC knife coating fabric -Reinforced Tarpaulin 420G

- 8' x 20' Clear Vinyl Tarp - 20 MIL - Fire Retardant Clear Vinyl

- rain proof pvc tarpaulin roof cover for truck body

- Heavy Duty 18oz D-Ring PVC Flatbed Truck Steel Lumber Tarps

- Clear Glass Tarpaulin Pergola Sides Plastic Awning Transparent Waterproof Terrace PVC Curtains

- 6' x 20' Clear Vinyl Tarp - 20 MIL - Fire Retardant Clear Vinyl

- PVC knife coating fabric inflatable material-Dark brown

- PVC knife coating fabric - Cover Tarpaulin Blue and Green

others also viewed

- Industrial fabric popular science series Three---Basic fabric

- Advantages and uses of pvc coated fabric

- Clear vinyl Detailed introduction

- Instructions for using tarpaulin

- Which Colour Tarpaulin Is Best?

- The Benefits of Canvas Tarps

- Basic introduction of Industrial Fabrics

- What Type Of PVC Tarpaulin Lasts The Longest?

- What Is The Best Material For Blackout Blinds?

- What is the GSM of PVC tarpaulin?